Be Frugal-If you have not already, read the book “Millionaire Next Door.” This really opened my eyes to the world of the rich. People become rich through saving and investing wisely, not by earning a great deal of money.

Pay yourself first

In 1926, George Clason wrote a book called The Richest Man in Babylon- one of the great success books of all time. In my opinion, the most powerful idea that the book presents is that you should live on 90% of your income. That is, for every £100 pound that you take home, automatically £10 pound should go into savings. If you can save more, great, but 10% is the minimum. This is the only way to stop living from pay check to pay check. The situation is slightly different if you are in debt. The book then advises that you live on 70% of your income. 20% would go to pay down the debt, and 10% would still go to savings. Once the debt is gone, you can go back to living on 90%.

Look into Compound interest if you haven't already

Albert Einstein once called compound interest “the greatest mathematical discovery of all time”.The concept is this. When you invest money you earn interest on your capital. The next year you earn interest on both your original capital and the interest from the first year. In the third year you earn interest on your capital and the first two years’ interest.

The concept of earning interest on your interest is the miracle of compounding. Once your debt is under control, you can start to use Compound Interest in your Investing strategy.

The earlier you start investing, the more time you leave for the miracle of compound interest to take effect.Basically you are getting “interest on the interest” earned so the net change increases every year provided you make no withdrawal.

Compound Interest works on 2 variables – time and rate – the longer your money has to grow, the faster it will grow, and the greater the interest rate your money is getting then the greater will be your rewards. It’s very much like a snowball effect. As your capital rolls down the hill it becomes bigger and bigger.

Even if you start with a small snowball, given enough time, you can end up with an extremely large snowball indeed.

“Many of today’s youth have credit cards before they leave high school, yet they have never had a course in money or how to invest it, let alone understand how compound interest works on credit cards.” Robert Kiyosaki

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council Cllr Ergin Erbil was elected as the new Leader of Enfield Council

Cllr Ergin Erbil was elected as the new Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

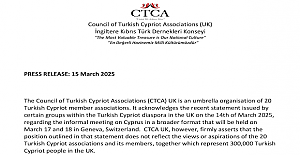

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu

Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu Enfield Council at a special awards ceremony

Enfield Council at a special awards ceremony Enfield Council continues to invest in Edmonton, supported by £11.9 million in funding

Enfield Council continues to invest in Edmonton, supported by £11.9 million in funding Survey shows improvements in Enfield Council’s housing services

Survey shows improvements in Enfield Council’s housing services Why is Thames Water in so much trouble?

Why is Thames Water in so much trouble?