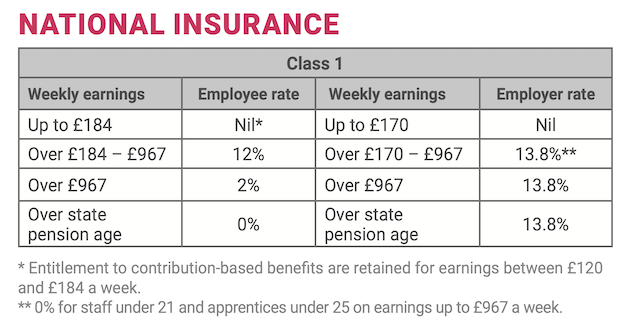

AVRUPA TIMES/LONDON-INCOME TAX ALLOWANCES, Personal allowance, VEHICLE AND FUEL BENEFITS-IN-KIND The taxable benefit-in-kind is calculated as a percentage of the car’s UK list price. The percentage depends on the car’s CO2 emissions in grams per kilometre (g/km).Subject to certain conditions, the unused amount of the annual allowance can be carried forward up to three years and used once the current year annual allowance has been fully utilised.

INCOME TAX ALLOWANCES

2021/22. 2020/21

Personal allowance*

£12,570 £12,500

Personal savings allowance – Basic-rate taxpayer

– Higher-rate taxpayer

– Additional-rate taxpayer

£1,000 £500 £0 £1,000 £500 £0

Dividend allowance at 0%

£2,000. £2,000

Marriage/civil partner transferable allowance**

£1,260. £1,250

Trading and property allowance***

£1,000. £1,000

Rent-a-room allowance

£7,500. £7,500

Blind person’s allowance

£2,520. £2,500

* The personal allowance is reduced by £1 for each £2 of income from £100,000 to £125,140.

** Any unused personal allowance may be transferred to a spouse or civil partner, where the recipient is not liable to higher or additional-rate tax.

*** Landlords and traders with gross income from each of these sources in excess of £1,000 can deduct the allowance from their gross income as an alternative to claiming expenses.

HERE IS THE FULL LIST AND RATES PLEASE CLICK

OR CALL 020 8886 9222 VISIT www.accountingdirectplus.com send an e-mail: [email protected]

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise