AVRUPA TIMES/FINANCE-LONDON-HMRC has issued a last call to around 250,000 traders, highlighting urgent actions to take if they wish to continue trading with the EU from 1 January 2021.The UK will leave the EU single market and customs union when the Brexit transition period comes to an end on New Year’s Day.From then, new customs and tax rules will affect businesses that either import or export goods to the EU, regardless of a free trade deal being struck.

GOVERNMENT BODY URGES CAPITAL GAINS TAX OVERHAUL

Current capital gains tax rates are too complex and should be aligned with income tax rates, according to the Office for Tax Simplification (OTS).The OTS said harmonising capital gains tax rates with income tax rates could raise an extra £14 billion a year for the Treasury, equating to £70bn over five years.

SELF-EMPLOYED FEAR TAX RETURNS MAY AFFECT FOURTH SEISS CLAIM

Some self-employed workers fear submitting their 2019/20 tax return early might affect their ability to claim a fourth taxable grant from the Government.The deadline to submit tax returns for 2019/20 through self-assessment is on or before midnight on 31 January 2021, with around 10.7 million returns sent in last year.

Read The Full Article

Contact: ADPL LLP | www.accountingdirectplus.com/ | 020 8886 9222 | [email protected]

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

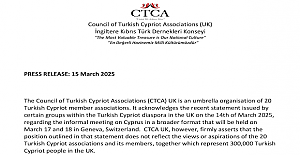

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise