The OBR releases its five-year forecast for the UK economy and public finances. Furnished holiday lettings regime abolished but there are investment incentives and VAT threshold increases. Vote-winning announcements are always expected from a Chancellor’s Budget in an election year. Despite the stagnant economy and limited fiscal headroom, Jeremy Hunt still announced a few tax cuts and other surprises. With the UK entering a technical recession at the end of 2023 and a general election on the cards this year, Chancellor Jeremy Hunt was under pressure to deliver a Spring Budget that demonstrated fiscal responsibility and generosity. Dubbing the fiscal statement a ‘Budget for long-term growth”, Hunt focused his speech on delivering tax breaks, boosting investment and tackling unfairness in the UK tax system. Talk to ADPL about your business. 293 Green Lanes, London, N13 4XS. Tel:020 8886 9222

www.accountingdirectplus.com

One of the Chancellor’s most significant announcements was a 2p cut to National Insurance contributions (NICs) in April, on top of the 2p he already cut in last year’s Autumn Statement.

Workers will see their NIC rates fall by four percentage points in less than six months.

Other personal measures included extending the freeze and 5p cut on fuel duty for a further 12 months, cutting the higher capital gains tax (CGT) rate on residential property sales, and reforming the high income child benefit charge (HICBC) to increase the threshold and make the system fairer for single-earner households. For businesses, Hunt promised enhanced funding for ‘high-growth industries’ and focused support for the creative sector. The VAT threshold will also rise from £85,000 to £90,000 in April, reducing

the administrative burden for tens of thousands of businesses. To pay for these changes, the Chancellor announced several revenue-raising initiatives, such as replacing the current tax regime for non-domiciled individuals (non-doms), a new levy on vaping products and an extension of the windfall tax levy on oil and gas companies. Hunt also abolished the furnished holiday lettings relief, claiming this move would raise capital and improve the availability of long-term rental properties. This report outlines the major announcements in the Chancellor’s speech, breaking down the latest economic forecast from the Office for Budget Responsibility (OBR) and what the changes could mean for businesses and individuals alike.

SPRING BUDGET 2024 www.accountingdirectplus.com

ECONOMIC OUTLOOK

ECONOMY DOING BETTER THAN EXPECTED, SAYS OBR

The Chancellor’s ‘Budget for long-term growth’ recognises that the inflation battle is not yet over - as the OBR says that the economy is doing better than expected, but we are entering a period of stagnating output.In his Spring Budget speech, Jeremy Hunt said he had set out a plan to deliver long-term growth for the UK that will build a high-wage, high-skill economy with a path to more investment, more jobs, more productive public services and lower taxes.However, given the limited fiscal headroom shown through The Office of Budget Responsibility’s (OBR) economic report, the Chancellor’s plans for a pre-election Budget tax giveaway had to be somewhat reined in.

According to the OBR, the Chancellor had financial headroom of around £9bn (compared to £13bn in November), which the OBR said was “a tiny fraction of the risks around any forecast”.

REAL GDP

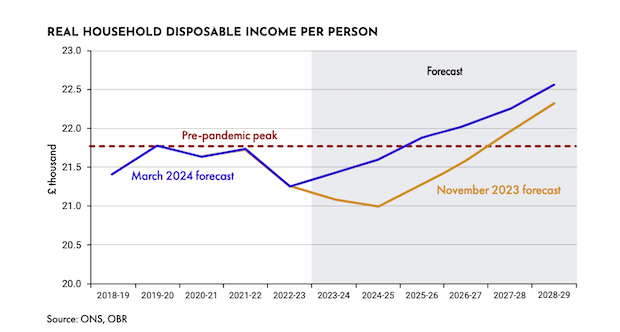

REAL HOUSEHOLD DISPOSABLE INCOME PER PERSON

THE BACKDROP OF RECESSION AND INFLATION

LIVING STANDARDS BACK TO PRE-PANDEMIC LEVELS BY 2025

INFLATION RATE TO FALL MORE GRADUALLY IN 2024

CPI INFLATION

INTEREST RATES EXPECTED TO COME DOWN

PERSONAL CHANGES

HUNT SLASHES NICS AND REFORMS “UNFAIR” TAX POLICIES

NATIONAL INSURANCE CUT

NON-DOM ABOLISHMENT

CHILD BENEFITS

PERIOD CHILD BENEFIT RECEIVED

LOWER UPPER INCOME INCOME THRESHOLD THRESHOLD

BRITISH ISA INTRODUCTION

TALK TO ADPL FOR YOUR BUSINESS

The way in which tax charges (or tax relief, as appropriate) are applied depends upon individual circumstances and may be subject to change in the future. The information in this report is based upon our understanding of the Chancellor’s 2024 Spring Budget, in respect of which specific implementation details may change when the final legislation and supporting documentation are published.This document is solely for information purposes and nothing in this document is intended to constitute advice or a recommendation. You should not make any investment decisions based upon its content. Pension eligibility depends on individual circumstances.Whilst considerable care has been taken to ensure that the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information.

Accounting Direct Plus: Accounting Firm In London | London - Accounting Direct Plus is one of the leading accountancy firms in the country. Over the course of 20 years, we have collated an unrivalled knowledge,

Talk to ADPL about your business

293 Green Lanes, London, N13 4XS

020 8886 9222

www.accountingdirectplus.com

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise