The UK annual inflation unexpectedly fell from 4.6% to 3.9% in November, the lowest since Sept. 2021, and well below forecasts of 4.4% as cheaper gasoline and lower food prices contributed to a sharp decline.

According to the Office for National Statistics (ONS), annual core inflation has also diminished to 5.1%, the lowest since January 2022.

This marks the second consecutive month of significant falls in the inflation rate, offering some respite to households across the country.

Additionally, the ONS reported that food prices contributed to moderate inflation. While overall food prices rose by a modest 0.3% month-on-month, the increase was considerably slower than in previous months.

Notably, certain food items, such as bread and cakes, experienced a reduction in price compared to the preceding month.

However, despite this positive shift, food prices are still up annually by 9.2%, though the rate is slightly lower than the 10.1% recorded in October.

"Inflation has more than halved, from over 11% to 3.9% - so we can see the plan is working. With inflationary pressures easing, alongside the major business tax cuts I announced in the autumn statement, we are back on the path to healthy sustainable growth," UK Chancellor of the Exchequer Jeremy Hunt said in a statement posted on X.

Despite the latest figures, the ONS chief economist, Grant Fitzner, said: "Prices remain substantially above what they were before the invasion of Ukraine."

The unexpected drop in inflation in November fueled speculation that the Bank of England will begin cutting interest rates sooner than initially anticipated.

In response to inflation, the bank has consistently raised interest rates to manage the situation, resulting in increased mortgage repayments for millions.

Some economists now speculate that the bank could commence rate cuts in the first half of 2024, a considerably earlier timeframe than previously predicted.

Despite the substantial decrease from its 2022 peak, inflation remains nearly double the Bank of England's 2% target. For many households, the relief is tempered by persistently high energy bills and borrowing costs.

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

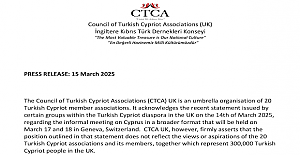

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise