AVRUPA TIMES-The Government of the United Kingdom has typically held two major fiscal events each year – the Autumn Budget and the Spring Statement – with each updating on the economy’s performance, significant tax changes, fiscal measures and adjustments to allowances. In 2024, however, Chancellor Rachel Reeves committed to limiting major tax changes to one fiscal event a year, meaning that she had no new tax policies to introduce at the Spring Statement on 26 March 2025. Despite the absence of immediate changes to personal or business taxation, this Spring Statement remains highly relevant for individuals, business owners and accountants. The Office for Budget Responsibility (OBR) released its latest Economic and Fiscal Outlook (EFO) alongside the Chancellor’s speech, containing revised forecasts for growth, inflation, borrowing and debt. These forecasts inform the government’s approach to public spending, highlight existing economic challenges and shed light on how the government aims to meet its self-imposed “fiscal rules” in the years ahead.

The year so far has been characterised by continuing external uncertainties. The global economy continues to experience notable shifts in growth patterns, trade relationships and geopolitical concerns – many of them linked to the war in Ukraine, ongoing supply-chain disruptions and the tail-end pressures of the global pandemic. Higher interest rates in numerous major economies have raised the cost of government borrowing, while many countries confront stubborn inflation rates. Against this backdrop, the Chancellor’s Spring Statement takes on additional importance as it clarifies how the government plans to navigate these uncertainties and improve the UK’s fiscal position while attempting to foster

growth and protect public services.

This guide aims to provide a clear breakdown of the Statement’s content, its potential impacts on individual taxpayers and its significance for businesses. It also aims to clarify how the government’s spending decisions may lead to opportunities or challenges for different sectors of the economy. Finally, it explores the relevant announcements regarding the welfare system, which may affect workforce participation rates, and the additional funding for defence and infrastructure projects, which in turn could stimulateemployment and growth in specific industries.

OVERVIEW OF THE SPRING STATEMENT

On 26 March 2025, Chancellor Rachel Reeves delivered her Spring Statement in the House of Commons, followed by the publication of a series of official tax-related documents on gov.uk. While the Chancellor’s speech itself contained no major new tax measures, these supporting documents clarify a number of supplementary items. In particular, they confirm:

an increase in penalties for late payment of VAT and MTD for income tax

guidance on draft legislation for potential future changes to Making Tax Digital (MTD) record-keeping requirements

preliminary consultation points regarding possible alignments of tax deadlines across income tax and corporation tax.

These clarifications reinforce that no immediate changes to headline tax rates or allowances took effect on 26 March 2025 but shed light on the government’s future direction. As a result, attention now shifts to the Autumn Budget, though small administrative adjustments orpilot schemes may still emerge in the interim.

Key themes that emerged from the Statement include the following.

•

Maintenance of fiscal rules: The

government insists it remains on

track to balance the budget by

2029/30 (in line with its “stability

rule”). Despite a downgraded growth

forecast in the immediate term,

careful management of departmental

spending, efficiencies in welfare

and the generation of additional

tax revenue through enhanced

compliance measures have enabled

the government to maintain a

projected surplus of £9.9bn in

2029/30.

No immediate tax announcements:

True to her word, the Chancellor

introduced no new tax or duty

changes. All eyes therefore remain on

the Autumn Budget, where there may

well be “tax gymnastics” (as some

commentators have suggested) to

tackle an uncertain fiscal outlook.

•

Defence spending and national

security: Against the backdrop

of continuing global tensions, the

government pledged an additional

£2.2bn for the Ministry of Defence

in the 2025/26 financial year. The

priority here is ensuring military

readiness, the acceleration of new

technologies and supporting global

alliances, which the Chancellor hopes

will also offer an economic boost via

growth in high-tech research

and innovation.

Housing and planning reforms:

A significant portion of the

government’s growth narrative

revolves around boosting

housebuilding to levels not seen in

over 40 years. According to OBR

analysis, the government’s planning

reforms could deliver a major fillip

to economic growth over the next

decade, with forecasts indicating a

cumulative uplift to gross domestic

product (GDP) by 2029/30 (and

potentially beyond).

•

Reduced projections for 2025

growth: The OBR has revised its 2025

growth projection downwards from

2% to 1%. However, it simultaneously

indicated slightly improved prospects

for each subsequent year to 2029,

suggesting that while caution is

warranted for the current period,

there remains some optimism for the

medium term.

Efficiencies in the public sector:

Beyond the headline defence and

housebuilding announcements,

the Chancellor outlined a goal to

bring public spending under tighter

control by cutting costs, streamlining

processes and cancelling thousands of

government credit cards. She reiterated

that while the government stands by

its commitment to invest in strategic

sectors, it also seeks to reduce

inefficiencies in day-to-day operations.

Accounting Direct Plus

t: 020 8886 9222

293 Green Lanes , London , N13 4XS

https://accountingdirectplus.com

ACCOUNTING DIRECT PLUS

ADPL is one of the leading accountancy firms in the country. Over the course of 20 years, we have collated an unrivalled knowledge, unparalleled attention to detail and unmatched service for our clients. We're determined to maintain our proud reputation of reliability & efficiency. Your business & finances deserves someone that values its integrity as much as you do. Join our vast London support network and find out how our team can immediately transform the way you do business.

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council Cllr Ergin Erbil was elected as the new Leader of Enfield Council

Cllr Ergin Erbil was elected as the new Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

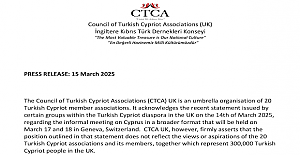

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu

Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise