Rental price growth in the UK has been at its highest rate since record-keeping started in 2016, official data showed on Monday. Private rental prices in Britain rose by 4% in the 12 months to November 2022, up from 3.8% in the 12 months to October 2022, according to the Office for National Statistics.

Nearly a quarter, 26%, of all renters surveyed in December reported their rent payments went up in the last six months, as the UK faces a bitter cost-of-living crisis triggered by soaring inflation and a deteriorating economy.

Renters spend 24% of their median weekly expenditure on rent compared to mortgage holders who spend 16% of their median weekly expenditure on their mortgage.

Meanwhile, mortgage interest rates started rising in 2022. "This is likely to make borrowing more expensive for those with fixed rates deals coming to an end in 2023," the statistical office said.

It further said: "More than 1.4 million households in the UK have been seeing the prospect of interest rate rises when they renew their fixed rate mortgages in 2023."

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council Cllr Ergin Erbil was elected as the new Leader of Enfield Council

Cllr Ergin Erbil was elected as the new Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

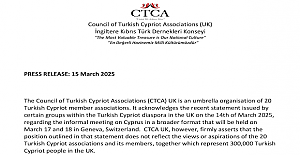

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu

Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise