VAT-registered firms were not required to make VAT payments during this deferral period, and initially had until 31 March 2021 to pay any liabilities.Around 1.8 million taxpayers missed the 2019/20 deadline for self-assessment on 31 January 2021, according to figures published by HMRC.The tax authority revealed 1,790,368 people failed to beat the midnight deadline, almost double last year’s total of 958,296.HMRC attributed the spike in the number of personal taxpayers missing this year’s midnight deadline – about 15% of the 12.14m returns due – to the impact of COVID-19.

PERSONAL ALLOWANCE AND HIGHER-RATE THRESHOLD TO INCREASE 0.5%

A 0.5% increase to the personal allowance and higher-rate of income tax will be in place from 6 April 2021, according to the Treasury.Both thresholds will increase in line with the Consumer Prices Index (CPI) rate of inflation figure for September 2020, which was 0.5%.This means the personal allowance will rise from £12,500 to £12,570 and be in effect throughout the UK for 2021/22.

For details: Accounting Direct Plus ADPL- 293 Green Lanes, Palmers Green, London N13 4XS | Email: [email protected] | Tel: 020 8886 9222

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

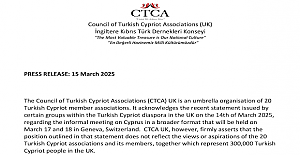

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise