Avrupa Times/ Guest Writer: Mr. Sevki Acuner

Emerging Markets, the US Savings and Loans, Asian, Italian, Russian, Turkish, Latvian, Icelandic, the 2018 ABS/CDO, the British crisis are but a few instances to remember.. Countless big name global banks have been paying tens and tens of billions of dollars of fines over the years for violations of compliance rules and sanctions. Denmark is now living through the shock and embarrassment of the $200 billion money laundering crisis caused by one of its banks through its Estonian branch. The key underlying causes of the compliance problems these banks and systems are facing can not be far or disconnected from the causes of banking crisis that we keep re-living...

When you step back and take a look from a distance, the picture hardly inspires any confidence or comfort, for a sector that is essential to national and global economic growth and stability.. This picture gets rather puzzling when you consider the kind of remuneration the senior executives in the sector get paid which is paid to attract the most talented and smart people into the sector, or how much supposed attention the sector gets from national and international authorities. In short, If i were to describe this landscape, I would call it a big mess trying to put a decent face on.. I don’t even want to count the number of sticks that have been put after the word “Basel” to describe several global framework of rules and guidance the authorities have tried to regulate and control the sector with...

Does anyone remember how many times mega provisions and write offs have had to be taken by each ( and the same) global banks to “clean up” their past sins...

So what is wrong? Is there any chance of correcting what would appear to be systemic and fundamental design (and operational) faults that are marring the system across the world..

The answer to the question and solution to it has to come, in my view, from a close look at it through the prism of a four stage review process going through the sequence of 4 concepts I stated at the preamble to my article. Adequacy of compétence in crucial areas of responsibility and expertise is no doubt a most important factor.

Finding a broad based management competence distilled into an all powerful CEO is becoming increasingly problematic due to growing complexity and sophistication of the business and the resulting increased specialisation of executives in their career paths. For me, this is calling for a more careful distribution of authority, responsibility and accountability at the very top of financial institutions, creating a more collegiate “body of equals” with the coordinating role assigned to another equal with no additional executive business line responsibilities. Compensation structures also has to be aligned very closely with long term and sustainable value creation. They would also have to be put on more reasonable levels to curtail temptation of tinkering with numbers or taking excessive risks to get them..

Governance is about the architecture of the network of responsibilities and accountabilities among the stakeholders across the entire structure of an institution with articulation of competencies needed at all levels for the achievement of agreed targets. The strength of Governance is perhaps even a more determining factor for long term sustainable success of an institution than management because strong Governance would see to changing bad or inadequate management to correct problems...The Diversity and complémentarité of experiences of Board members and genuine empowerment of Boards are essential for their effectiveness..

Regulation has to be clear, comprehensive and consistent. After so many refined rules regulations and interventions, I wonder weather the national or supranational authorities are applying them firmly. Those who chose to work in regulatory/supervisory roles charged with overseeing the health of the individual banks and the system as well as with enforcing compliance with regulations and rules should then not be allowed to work for the very institutions they have supposedly regulated/supervised. This would create a serious conflict of interest...The regulators should come from senior roles in the sector for purposes of ensuring competency, but should not be able to go back....They must not be bureaucratically minded people but action oriented, courageous executives. I remember a post mortem TV interview with the then Governor of the Bank of England at the time of Northern Rock and High Street banking crisis. His excuse for failure to prevent the collapse was that if he had intervened, he would have broken the rules and regulations. He seemed to have overlooked the fact that those very same regulations and rules were put in place in order to prevent the breakdown of the system in the first place...

I will conclude by saying that I would call the entire package that I talked about above as “Governance”...Good governance is crucial to proper functioning of the financial system, indeed of any enterprise, sector or system. That must be the focus and objective of the ultimate policy makers, our politicians....

Our quest writer Mr. Sevki Acuner

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council Cllr Ergin Erbil was elected as the new Leader of Enfield Council

Cllr Ergin Erbil was elected as the new Leader of Enfield Council Rauf Raif Denktas and Dr. Fazıl Kucuk II. International Cyprus Studies

Rauf Raif Denktas and Dr. Fazıl Kucuk II. International Cyprus Studies We continue our promotional activities in Europe, primarily in the UK said Ahmet Aras

We continue our promotional activities in Europe, primarily in the UK said Ahmet Aras London aging faster than any other UK city, study reveals

London aging faster than any other UK city, study reveals Cold weather health alerts issued ahead of snow

Cold weather health alerts issued ahead of snow Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu

Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu Besiktas are said to be in advanced talks to secure the Norwegian coach

Besiktas are said to be in advanced talks to secure the Norwegian coach Footballers are celebrating after Enfield Council officially opened a pitch

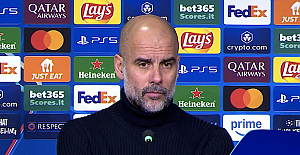

Footballers are celebrating after Enfield Council officially opened a pitch  Pep Guardiola's Manchester City beaten by Juventus

Pep Guardiola's Manchester City beaten by Juventus Millions face council tax rise of more than 5%

Millions face council tax rise of more than 5% A new banking hub has opened at Enfield’s Ordnance Unity Centre Library

A new banking hub has opened at Enfield’s Ordnance Unity Centre Library Transport for London Weekend travel information

Transport for London Weekend travel information UK government to launch public inquiry into deadly Southport attack

UK government to launch public inquiry into deadly Southport attack