Europe’s biggest bank confirmed Monday that it would give up the lease on its prominent tower of 40-plus stories in favor of a much smaller building closer to the city center. It follows similar moves by other big companies to get rid of expensive office space in cities around the world.

In three years’ time, HSBC (HSBC) plans to move from 8 Canada Square to Panorama St. Paul’s, a new development currently under construction in the City of London, the UK capital’s historic financial district. In 2016, the bank decided to stay in London, rejecting calls to relocate to Asia, which generates the vast majority of its profits.

The bank has long been a mainstay of Canary Wharf, where it occupies 1.1 million square feet of office space. Its new HQ will be just 556,000 square feet.

The lender says it hopes to relocate in late 2026, a few months before its Canada Square lease expires in early 2027.

The move to scale down its sprawling headquarters fits into a wider trend. Around 50% of major global companies will need less real estate in the next three years, with US cities — led by San Francisco — most at risk of empty offices, according to research released earlier this month.

Most anticipate a reduction of between 10% and 20%, according to the survey of 347 companies around the world by Knight Frank, a UK-based property firm.

The survey highlighted changes underway in the commercial real estate market, which is under strain from waning demand for office space following a post-pandemic rise in working from home, as well as from high interest rates.

HSBC’s leadership has been vocal about its desire to avoid ending up with unnecessary office space as a result of the changes.

In 2021, CEO Noel Quinn said the bank planned to cut its global real estate footprint by 40% “over the next several years” and adopt a hybrid work model, with employees splitting their time between the office and home. Therefore, HSBC was widely expected to give up many of its city center leases expiring in the coming years.

Two years ago, Quinn also famously took up hot-desking as the bank did away with its executive floor of swanky private offices in favor of open-plan working for everyone.

The lender’s new office is intended to provide employees with flexible workspaces, according to the bank. It did not immediately respond to a request for further details or comment.

HSBC is a key tenant in Canary Wharf, and its planned departure raises questions about whether other companies will also think about leaving. Canary Wharf Group, which manages real estate in the area, declined to comment when asked about the matter Monday.

Within the financial sector, other banks, including Lloyds (LLDTF) and Standard Chartered (SCBFF), have announced plans in recent years to dump reams of expensive office space and offer flexible working arrangements to staff.

Last year, Barclays (BCS) also gave up a former hub for its corporate and investment bank staff in Canary Wharf to bring all its employees together into one building in the same area, citing a desire for “efficiencies across the group’s real estate portfolio” as a major reason for the move.

That office, which can house up to about 5,140 desks, is now vacant and listed for lease by Jones Lang LaSalle.

According to Canary Wharf Group, the neighborhood has continued to enjoy strong demand from tenants both within and outside finance, with 415,000 square feet of office space let last year, above its annual average over the past decade.

The area, which is also home to retail malls and restaurants, has benefited from a boost in foot traffic since the opening of the Elizabeth line, a London subway connection that started running last May, the group said.

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

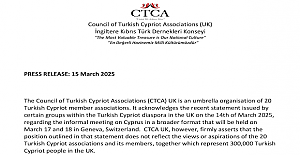

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise