The UK's largest mortgage lender said prices rose 1.1% last month, taking the average property value to £281,974. But the Halifax said the rise was due to a lack of homes for sale, and demand from buyers remained weak. It expects prices to fall until 2025, with buyers facing higher interest rates and cost of living pressures. House prices in October were down 3.2% from the same point last year, according to the Halifax's data. "Prospective sellers appear to be taking a cautious attitude, leading to a low supply of homes for sale," said Kim Kinnaird, director of Halifax Mortgages. "This is likely to have strengthened prices in the short term, rather than prices being driven by buyer demand, which remains weak overall."

Up until recently, the Bank of England had been increasing interest rates steadily in an attempt to tame soaring inflation. The rise has led to higher mortgage rates for homeowners. While the Bank has now left rates unchanged at 5.25% at its past two meetings, it is not expected to cut them anytime soon. Given that outlook, the Halifax said it expected "house prices to fall further overall - with a return to growth from 2025". However, it added that the price falls in recent months have come after a long run of gains, and it noted that average house prices are still around £40,000 above pre-pandemic levels.

The Halifax said that house prices in all UK nations and regions were down from a year earlier. The biggest fall was in south-east England, where prices dropped by 6%, while Scotland saw the smallest decline, down just 0.2% over the year. It also said that despite overall demand for housing being weak, the first-time buyer market had "held up relatively well". It said buying a first home remained an attractive option, "especially against the backdrop of rental prices increasing".The price increase in October echoed the findings of rival lender the Nationwide, which said last week that values rose 0.9% last month. However, the Nationwide said prices were still lower than a year earlier, and that activity in the housing market remained "extremely weak" with buyers struggling in the face of higher mortgage rates. Both the Halifax and Nationwide base their survey data on their own mortgage lending, so the figures do not include those who purchase homes with cash or buy-to-let deals. According to the latest available official data, cash buyers currently account for more than a third of housing sales.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said buyers were still "horribly thin on the ground", with little sign of any change in the immediate future. She added that recent Bank of England figures showing a "miserable" number of mortgages were approved in September was an indication the market will remain subdued. "It may take a significant shift in mortgage rates before more enthusiasm returns to the market," she said. But the head of online estate agent Purplebricks, Sam Mitchell, told the BBC's Today programme there were signs that mortgage lenders were starting to compete for customers. "Yesterday we saw both Halifax and Virgin drop their rates, which I think is super encouraging going into what's typically a quieter time of year, [and] bodes very, very well for 2024," he said.

Prime Minister Keir Starmer's 2025 Easter message

Prime Minister Keir Starmer's 2025 Easter message After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

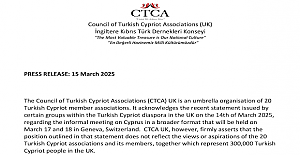

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World The 'Prince of Paris' has impressed in his first EuroLeague season

The 'Prince of Paris' has impressed in his first EuroLeague season Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Barclays has become the biggest UK lender so far to cut mortgage rates

Barclays has become the biggest UK lender so far to cut mortgage rates THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS

THE SPRING STATEMENT EXPLAINED, UK ECONOMIC OUTLOOK AND GROWTH FORECASTS Launch of Made in Enfield gift shop to celebrate local artists and designers

Launch of Made in Enfield gift shop to celebrate local artists and designers Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise