In 2016, Facebook's tax bill rose to £5.1m, following a major overhaul of the social media firm's tax structure.

However, the company's profits only climbed by £4m year-on-year from £58.4m to £62.7m in 2017.

The company's UK office provides marketing services and sales and engineering support to the company.

Facebook's revenue rose by a third year-on-year to £1.2bn in 2017, because of increased revenues from inter-company and advertising reseller services in 2017.

In 2017, Facebook gave out 1.48 million restricted ordinary shares (RSU) to employees, a move that reduces its tax liability.

The publication of Facebook's 2017 tax accounts follows extensive criticism from policymakers and the media over the last 12 months of how much tax tech giants typically pay in Europe.

Large technology companies have been condemned for moving sales through other countries and paying modest amounts of tax in the UK.

Last week, Chancellor Philip Hammond raised the prospect of introducing a new tax to address this concern.

Meanwhile, online payments firm PayPal has announced that its UK subsidiary has agreed to pay an extra £3.1m in tax following a review by HMRC.

Expansion plans

The social networking giant said that it intended to expand its UK operations further in the future.

In July, it signed a new facility lease in the UK.

In 2017, Facebook employed 330 more people than the previous year - a 34% increase in headcount.

BBC NEWS

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council Cllr Ergin Erbil was elected as the new Leader of Enfield Council

Cllr Ergin Erbil was elected as the new Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

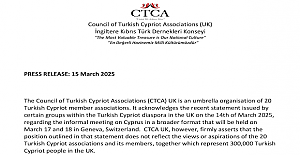

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu

Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu Trial used smart Wi-Fi sensors for live building occupancy data to optimise

Trial used smart Wi-Fi sensors for live building occupancy data to optimise Enfield Council at a special awards ceremony

Enfield Council at a special awards ceremony Enfield Council continues to invest in Edmonton, supported by £11.9 million in funding

Enfield Council continues to invest in Edmonton, supported by £11.9 million in funding Survey shows improvements in Enfield Council’s housing services

Survey shows improvements in Enfield Council’s housing services