AVRUPA TIMES / BUSINESS / LONDON- ADPL INSIDER, JANUARY 2021. ANNUAL INVESTMENT ALLOWANCE REMAINS AT £1M UNTIL 2022. A temporary increase to the annual investment allowance has been extended until 1 January 2022, the Treasury confirmed. The allowance enables firms to fully offset the cost of qualifying capital items of plant and machinery against taxable profits. Since 1 January 2019, businesses have received faster tax relief for plant and machinery investments up to £1 million.

Here is the ADPL LLP Accounting Direct Plus january 2021 report

ADPL LLP : The move intends to stimulate business investment by further incentivising firms to invest in plant or machinery.After two years, the temporary measure was due to close on 31 December 2020 and revert to £200,000 from 1 January 2021.However, the latest one-year extension aims to boost confidence as companies look to weather the pandemic.

Financial Secretary Jesse Norman said:“It is vital that we support business through the difficult months ahead. Extending the allowance’s £1m cap will give businesses the confidence they need to invest into next year.”

Jeremy Coker, Association of Tax Technicians president, added:

“The extension will be very welcome for businesses with higher levels of qualifying capital expenditure. However, for many businesses whose relevant annual expenditure is no more than £200,000, it will simply delay an unwelcome complication.

“The Government should consider amending the legislation, so the allowance does not produce counter-intuitive results for businesses with lower levels of expenditure.”

ADPL LLP : "We can handle your tax return.- ADPL LLP | www.accountingdirectplus.com/ | 020 8886 9222 | [email protected] Contact us about the annual investment allowance.

HMRC ISSUES LAST REMINDER FOR 2019/20 PERSONAL TAX RETURNS

HMRC is reminding taxpayers that the deadline to submit 2019/20 personal tax returns through self-assessment is on or before midnight on 31 January 2021.

Last year, a record-breaking 11.1m taxpayers complied with filing their personal tax return for 2018/19 on time, while around 8% missed the deadline altogether.

More than 700,000 people left it to the last minute by filing their personal tax return on 31 January 2020. The Revenue is keen to avoid a repeat performance this month and is urging taxpayers to get their 2019/20 returns in early.

Karl Khan, director-general of customer services at HMRC, said:

“The vast majority of self-assessment customers complete their tax return by the 31 January deadline, but you can send it back now and get it out of the way.”

HMRC is also allowing taxpayers to spread the costs of their 2019/20 tax bill through the time-to-pay facility.

By encouraging early submission of the self-assessment tax return, taxpayers will have time to put a plan in place before the final balancing payment is due.“We know many customers will have been adversely affected by the coronavirus pandemic, or will need help to spread the cost of their tax bill,” added Khan.“That’s why we’ve made it quick and simple to set up a payment plan to spread the costs and help people get back on their feet.”

ADPL LLP INSIDER: ONE-YEAR FREEZE FOR BUSINESS RATES MULTIPLIER IN ENGLAND

One of the key factors that determine the tax on a business’s right to occupy commercial property in England has been frozen for 2021/22, the Chancellor has confirmed.

Buried in the supporting documents of Spending Review.2020 was a freeze on the business rates multiplier, which the Government expects to save retailers £575 million up to 2025.

The Government is also believed to be considering options for more COVID-19-related support through business rates reliefs and is expected to outline plans for 2021/22 reliefs imminently.

As the pandemic hit in March 2020, the Government introduced a 12-month business rates holiday across the retail, hospitality and leisure sectors.

That package is still in place until March 2021 and is currently providing companies with relief worth more than £10 billion in 2020/21.

However, retail groups have expressed concern that Chancellor Rishi Sunak might be waiting until Spring Budget 2021 in March to announce changes to the business rates system.

In normal circumstances by that point of the year, many retailers have usually made their plans for the forthcoming tax year.

Helen Dickinson, chief executive at the British Retail Consortium (BRC), said:

“A return to full business rates liability in April [2021] would be impossible for some firms to meet and freezing the multiplier in 2021/22 does not solve this problem.

“We are encouraged that the Government is considering options for further rates relief for businesses in England affected by COVID-19.

“Many retail businesses have been shuttered since November, depriving them of £8bn in sales.”

The BRC is urging the Government to set business rates in England at 50% to “reflect the fall in commercial property values and generate much-needed revenue for the Treasury”.

“This, along with an extension to the moratorium on debt enforcement, to encourage constructive dialogue between landlords and tenants on rents, will support the resilience of the retail industry,” added Dickinson.

ADPL LLP : "Speak to us about managing your business’s costs. ADPL LLP | www.accountingdirectplus.com/ | 020 8886 9222 | [email protected] Contact us about the annual investment allowance.

NATIONAL LIVING WAGE TO INCREASE ALONGSIDE AGE THRESHOLD FALL

Employers of low-paid workers in the UK will have to absorb another rise to the national living wage and pay it to over-23s from April 2021, the Chancellor has confirmed.

Rishi Sunak confirmed the increase in his Spending Review 2020, in which it was announced the national living wage will increase from £8.72 to £8.91 an hour from 1 April 2021.

The national living wage age threshold will also fall to cover those aged 23 and over – up from over-25s in 2020/21.

Workers aged between 21 and 22 will see their minimum hourly rate increase to £8.36, while the rate for 18 to 20-year-olds is set to rise to £6.56 an hour.

Under-18s and apprentices will see their respective rates hit £4.62 and £4.30 an hour.

Bryan Sanderson, chair at the Low-Pay Commission (LPC), said: “The difficulty in looking forward, even to next April, is daunting.

“This prudent increase consolidates the considerable progress of recent years and provides a base from which we can move towards the Government’s target.”

The Treasury intends to increase the national living wage for workers aged 21 and over to £10.50 an hour by 2024.

Increasing these rates in the current climate, however, was a formidable task for the LPC, which had to balance the solvency risks to smaller employers with lower-paid workers’ needs.

Rain Newton-Smith, chief economist at the Confederation of British Industry, said:

“Many lower-paid workers have been the heroes of the COVID-19 crisis, but unemployment is rising in lower-paying sectors and these increases will be tough for some firms to afford.”

Ministers had been expected to freeze the 2021/22 rates after Sunak said in his Spring Budget 2020 speech that the rise will only go ahead “if economic conditions allow”.

Get in touch to discuss outsourcing your payroll.: ADPL LLP | www.accountingdirectplus.com/ | 020 8886 9222 | [email protected] Contact us about the annual investment allowance.

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield

After Nesil Caliskan a by-election will be held in Jubilee ward in Enfield Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights

Publishing the analysis, Labour’s Cllr Ergin Erbil said Everybody in Enfield deserves basic rights Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council

Gaza-Israel conflict Statement from Cllr Ergin Erbil, Leader of Enfield Council Cllr Ergin Erbil was elected as the new Leader of Enfield Council

Cllr Ergin Erbil was elected as the new Leader of Enfield Council The European Union called on Turkey to uphold democratic values

The European Union called on Turkey to uphold democratic values Turkish citizens in London said Rights, Law, Justice

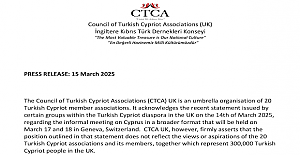

Turkish citizens in London said Rights, Law, Justice The Council of Turkish Cypriot Associations Geneva response letter

The Council of Turkish Cypriot Associations Geneva response letter Sustainable Development and ESG, Will This Become the Course for Turkic World

Sustainable Development and ESG, Will This Become the Course for Turkic World Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years

Saran Media And Euroleague Basketball Extend Media Rights Partnership for Four More Years Will Rangers be Jose Mourinho’s next victim?

Will Rangers be Jose Mourinho’s next victim? Jose Mourinho's Fenerbahce face Rangers on Thursday

Jose Mourinho's Fenerbahce face Rangers on Thursday Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu

Inzaghi stated that they felt the absence of our national player Hakan Çalhanoğlu Enfield Council at a special awards ceremony

Enfield Council at a special awards ceremony Enfield Council continues to invest in Edmonton, supported by £11.9 million in funding

Enfield Council continues to invest in Edmonton, supported by £11.9 million in funding Survey shows improvements in Enfield Council’s housing services

Survey shows improvements in Enfield Council’s housing services Why is Thames Water in so much trouble?

Why is Thames Water in so much trouble?